Machinery Valuation Services

ATO-Compliant Depreciation Schedules with Fraser Valuers

As an owner of an income-producing investment property, you may be entitled to claim tax deductions for the depreciation of your property’s assets over time. At Fraser Valuers, we specialise in ATO-compliant Depreciation Schedules, ensuring that you can maximise the value of your investment.

What Is Depreciation?

Depreciation is the gradual decline in the value of your property’s assets, which you can claim as a tax deduction. This can reduce your taxable income and increase your return on investment.

Who Is Eligible?

Properties built after September 1987 or those with improvements made after February 1992 may qualify for tax depreciation deductions. You can also claim depreciation on plant and equipment within your property, even for older properties (with specific exceptions for residential properties purchased after May 2017).

Why Choose Fraser Valuers?

As Registered and Qualified Quantity Surveyors, we are recognised by the ATO as the experts in estimating depreciable costs on your property. With our vast local knowledge and professional expertise, we provide detailed, accurate depreciation schedules for:

- Commercial Properties

- Industrial Properties

- Residential Properties

- Rural Properties

Contact Us Today

We understand the nuances of property investments and strive to offer a personalised service that maximises your tax benefits.

If you want to learn more or need a depreciation schedule prepared, get in touch with Fraser Valuers today.

Head Office: Suite 18, 81 Heeney Street, Chinchilla QLD

Phone: 07 4668 9681

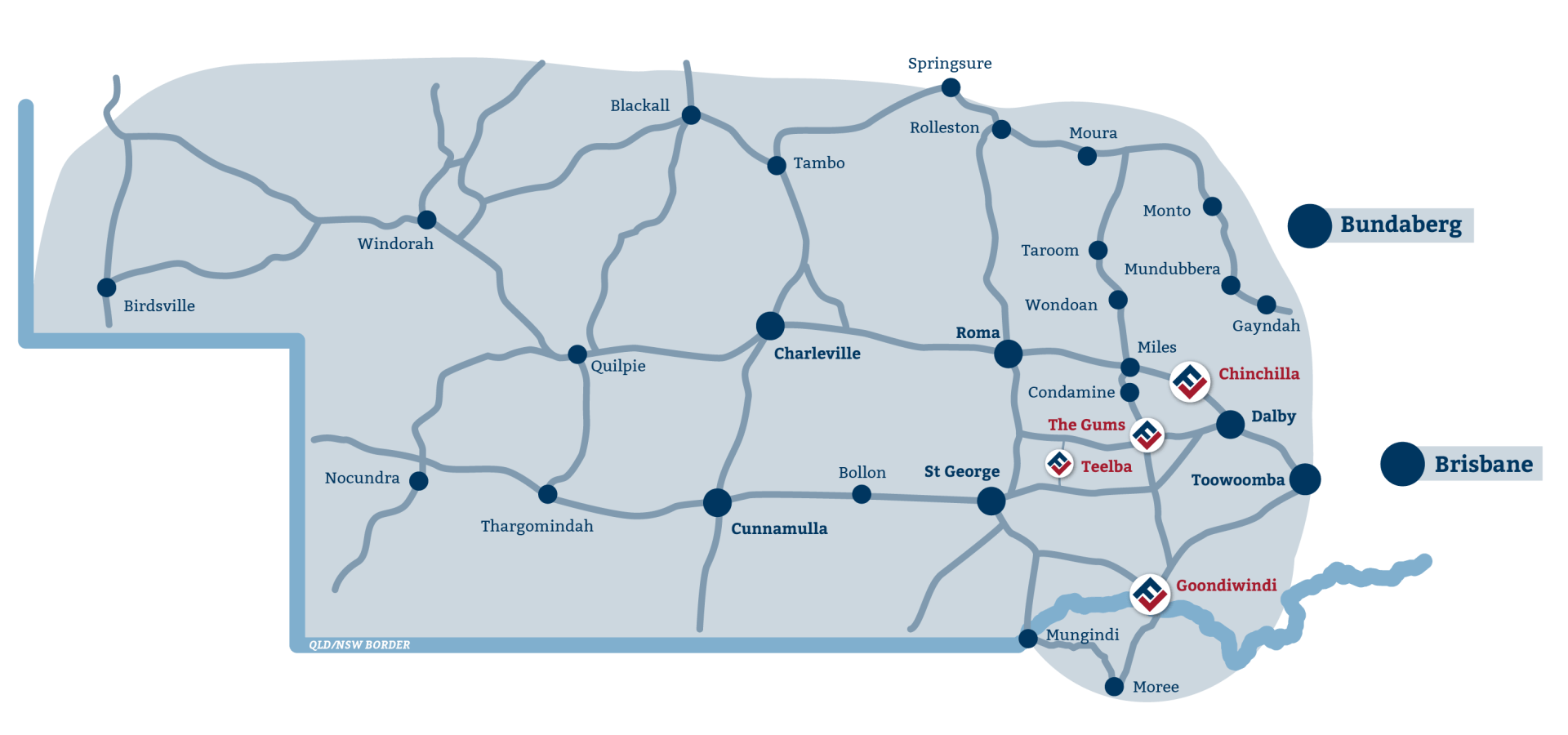

Our Service Area

Send us a message.

Looking to engage our services? Send us a message and we’ll be in touch.

We will get back to you as soon as possible

Please try again later

Accreditations

Site Links

Contact us

Head Office: Suite 18, 81 Heeney Street, Chinchilla QLD 4413

Fraser Valuers. Website by dms CREATiVE